The landscape of global mergers and acquisitions has undergone a seismic shift in 2025, marking a year of remarkable resurgence and strategic evolution.

With deal values soaring to near-record levels, this period represents a new era of opportunity and challenge for organizations everywhere.

Global M&A activity rebounded strongly, fueled by a confluence of factors that have reshaped how businesses grow and compete.

This article delves into the key trends, regional dynamics, and practical insights to help stakeholders navigate this transformative wave.

From megadeals to AI-driven strategies, the future of corporate expansion is being rewritten before our eyes.

In 2025, global M&A activity experienced a powerful revival, with deal values reaching heights not seen in years.

The first half alone saw a deal value of USD 1.93 trillion, a 20% increase from the latter half of 2024.

Full-year estimates project USD 4.8 trillion in value, making it the second-highest year ever recorded.

This surge was driven by a 5% year-over-year increase in volume across strategic, private equity, and venture capital deals.

The momentum continued into the second half, with larger transactions accelerating the pace.

Key statistics highlight this unprecedented growth:

This rebound signals a robust environment for corporate expansion and investment.

Megadeals, those exceeding USD 5 billion, played a pivotal role in driving the value increase.

They accounted for over 75% of the growth, with many involving infrequent acquirers.

Transformative deals represented 40% of those above USD 5 billion in the first ten months.

These transactions often involved acquiring companies worth more than 50% of the acquirer's market cap.

In the third quarter, eight megadeals over USD 10 billion were announced, the highest since late 2018.

This shift towards scope deals, focused on top-line growth, marked a departure from previous cost synergy strategies.

Examples of notable megadeals include:

AI-driven M&A also surged, with tech deals up over 75% and half of strategic tech deals citing AI benefits.

This trend underscores the growing importance of innovation in deal-making.

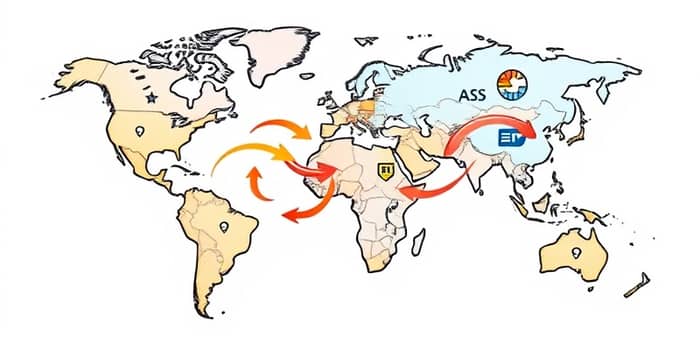

Activity was broad-based, with all regions and industries experiencing double-digit growth.

The US led in deal value, while Greater China dominated in deal count.

Below is a table summarizing key regional trends for 2025:

Regional drivers included governance reforms in Japan and regulatory catalysts in Europe.

Cross-border transactions gained momentum, with the Middle East and Asia showing significant inbound and outbound activity.

Key regional highlights include:

Understanding these dynamics is crucial for global strategy alignment.

Several factors converged to propel the 2025 M&A rebound, creating a favorable environment for deal-making.

Macroeconomic conditions, such as Fed rate cuts and lower financing costs, played a significant role.

Stock market highs and stabilizing policies reduced uncertainty and encouraged investment.

Pent-up demand from previous years also contributed to the surge in activity.

The tech and AI boom was a major catalyst, driving innovation across sectors.

Geopolitical tensions, while initially turbulent, normalized as buyers adapted to new trade realities.

Private equity activity revitalized, with over USD 2 trillion in dry powder available for investments.

Other drivers included shareholder activism in the UK and consolidation efforts in China.

Key elements fueling growth are:

These drivers highlight the interconnected nature of modern M&A.

Sustained strong activity is expected in 2026, led by cross-border deals between the US and Europe.

The focus will shift towards strategic, high-quality transactions rather than sheer volume.

A broad-based middle-market recovery is anticipated, supported by pent-up supply and demand.

Corporate megadeals and private equity take-privates will continue to drive growth.

Top trends for 2026 include:

Risks and challenges must be navigated carefully, including tariff volatility and regulatory hurdles.

Early integration planning will be critical for successful scale pursuits.

Infrequent acquirers making big bets raise questions about execution and long-term strategy.

As M&A activity intensifies, stakeholders must prioritize risk management and execution excellence.

Diligence for AI-related risks, such as intellectual property and data privacy, is essential.

Joint ventures with Chinese firms require careful consideration due to regulatory complexities.

EU merger reviews may present hurdles, necessitating proactive engagement with authorities.

Rising optimism among dealmakers is encouraging, but it must be balanced with practical caution.

Key execution considerations include:

By addressing these challenges, organizations can capitalize on the opportunities presented by the shifting sands of M&A.

The future promises continued innovation and growth for those who adapt strategically.

Embrace this dynamic landscape with informed decisions and a forward-thinking mindset.

References