In a rapidly evolving industrial landscape, the marriage of automation technologies and manufacturing processes is reshaping global markets and driving investor enthusiasm. Market observers are witnessing a powerful transformation as manufacturers embrace digital tools to optimize production and strengthen supply chains. Evidence shows that companies at the forefront of these initiatives are not only enhancing operational efficiency but also delivering meaningful return on investor capital in the public markets.

As the industry advances, smart manufacturing is attracting significant capital flows from institutional and retail investors alike. Stocks of automation pioneers are gaining traction, reflecting confidence in their ability to leverage cutting-edge technologies and sustain competitive advantages.

Recent estimates place the global smart manufacturing market at $405.82 billion in 2024, with forecasts projecting a rise to $459.15 billion in 2025 at a compound annual growth rate (CAGR) of 13.1%. Another outlook anticipates expansion to $833.96 billion by 2029, driven by a robust 16.1% CAGR. Regional breakdown indicates the Asia Pacific region leading with a 32% share in 2024 and the fastest growth trajectory through 2034.

In the United States, the smart manufacturing sector is valued at $80.25 billion in 2024 and is expected to surpass $206.24 billion by 2034, reflecting a 9.9% CAGR. Such growth underscores a global shift toward data-driven production ecosystems.

At the heart of smart manufacturing lies the integration of automation with artificial intelligence and machine learning. These technologies enable real-time decision-making across manufacturing, powering advanced predictive analytics and enhancing product quality. Manufacturers are increasingly deploying AI-driven systems to anticipate equipment failures and reduce unplanned downtime.

According to the 2024 State of Manufacturing report, 85% of manufacturers have either invested in or plan to invest in AI and ML technologies, signaling widespread adoption. By 2027, AI is projected to deliver the greatest impact on both quality management and cybersecurity resilience.

The Industrial Internet of Things (IIoT) is revolutionizing data collection by linking machinery and sensors in real time. Coupled with edge computing and 5G networks, manufacturers can process data locally and respond instantly to operational changes, reducing latency and alleviating network congestion.

Global partnerships, such as those between Alibaba Cloud and Siemens in China, are accelerating IIoT deployments, enabling smarter factories and driving economies of scale.

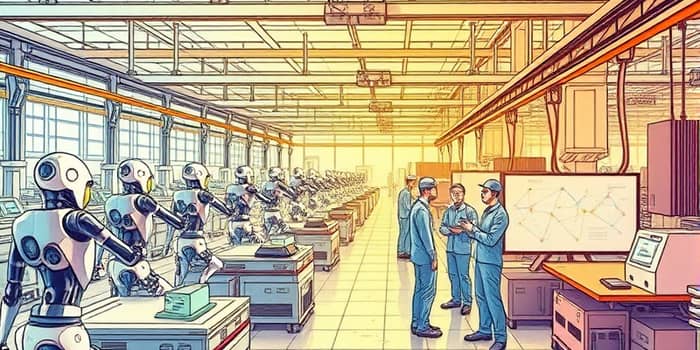

Robotics technology has evolved beyond fixed automation cells to versatile autonomous mobile robots (AMRs) that streamline materials handling and logistics. These systems deliver greater flexibility and scalability, adapting to fluctuating demand.

Simultaneously, trends in collaborative robots augmenting human tasks emphasize coexistence rather than replacement. Cobots work alongside human operators, assisting with repetitive or hazardous tasks and freeing personnel to focus on complex problem-solving and innovation.

Digital twins—virtual replicas of physical assets—offer manufacturers the ability to simulate and optimize processes before real-world deployment. By leveraging digital twins to simulate processes, companies can test scenarios, refine workflows, and reduce time to market.

Environmental considerations are also integral to smart manufacturing. Adoption of sustainable and circular production models supports energy efficiency, waste reduction, and the reuse of materials, aligning with global ESG goals.

As connectivity deepens, cybersecurity becomes paramount. Manufacturers are investing in advanced defenses to protect IP, secure data flows, and safeguard critical infrastructure from emerging threats.

Investors are gravitating toward publicly traded firms leading the smart manufacturing charge, including Rockwell Automation, Siemens, ABB, Fanuc, Schneider Electric, and Honeywell. Analyst forecasts suggest that early adopters of digital transformation will outperform peers through enhanced service offerings and operational efficiencies.

Companies leveraging end-to-end digitization report revenue growth of 15–20%, fueled by faster fault detection, reduced downtime, and better resource utilization. Cost optimization efforts yield significant savings in materials and maintenance expenses.

Enhanced agility allows manufacturers to pivot quickly in response to supply chain disruptions or shifting demand patterns, granting a strategic edge in volatile markets.

The smart manufacturing landscape will continue to evolve as AI, robotics, 5G, and edge computing advance. Ongoing innovation promises new use cases and deeper integration across value chains.

However, manufacturers must address integration with legacy systems, invest in workforce upskilling, and fortify defenses against cyber threats. Smaller players may face capital constraints, underscoring the importance of strategic partnerships and phased implementation approaches.

Ultimately, firms that successfully navigate these challenges will secure market leadership, driving shareholder value and fostering sustainable industrial growth in the digital era.

References