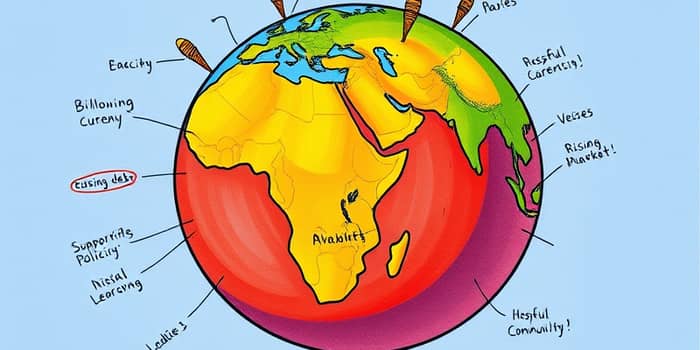

Emerging market economies worldwide are wrestling with rising debt burdens, currency pressures, and investor skepticism. This article explores the causes, current conditions, policy responses, and future prospects of this growing challenge.

Developing nations are facing record external debt service obligations, with over $400 billion due in 2024 alone. From 2020 through 2023, the world witnessed 15 sovereign defaults, driven by pandemic shocks, commodity price swings, and surging inflation. In sub-Saharan Africa, Latin America, and Southeast Asia, the risk of default is most acute as a result of tightening global monetary conditions and capital flight.

Many emerging market economies (EMEs) are also battling massive capital outflows, currency depreciation, and dwindling foreign reserves. These stressors amplify fiscal risks and limit governments’ room for maneuver in both monetary and fiscal policy.

Investor sentiment in EM debt markets cooled in early 2024 under the weight of strong US growth and persistent inflation. Higher US Treasury yields and a strengthening US dollar pushed local-currency and hard-currency bond yields upward, reflecting increased risk premiums.

Despite elevated yields, EME GDP growth is expected to remain resilient at around 3.9% in 2025, while inflation may ease from 5.9% in 2024 to 4.2% next year. These projections suggest pockets of stability, but underlying vulnerabilities persist.

Several factors converge to heighten debt stress in emerging markets:

Inflationary pressures in EMs were amplified in Q1 2025 by US tariffs and supply-chain disruptions, forcing central banks into difficult tradeoffs between containing inflation and supporting growth.

In response to these challenges, many EM central banks have adopted a cautious monetary policy stance. By raising policy rates, they aim to anchor inflation expectations and defend currencies, but face the risk of dampening economic growth.

Fiscal authorities in several countries have launched reforms to strengthen public finances. In Ghana, for example, newly implemented measures focus on greater transparency, pension reform, and streamlined public spending. These steps have begun to restore investor confidence and narrow sovereign yield spreads.

Global institutions have recognized the looming risk of a systemic debt crisis among EMEs. The IMF, World Bank, and G20 are under pressure to accelerate debt relief initiatives, particularly for the most vulnerable economies.

Emerging mechanisms such as debt-for-climate swaps and the recycling of Special Drawing Rights (SDRs) aim to link financing needs with sustainable development goals. By converting debt service into green investment, these tools can alleviate fiscal pressure while promoting climate resilience.

Portfolio managers continue to weigh risk against opportunity. High real yields in EM debt offer compensation for investors, but the elevated spreads also reflect lingering uncertainty. Some strategists argue that volatility driven by political headlines and global rate dynamics may create attractive entry points for long-term investors.

Intra-EM trade growth and regional diversification strategies are emerging as potential buffers against external shocks. ASEAN countries, for example, rely more heavily on local currency bond markets, insulating them somewhat from abrupt capital flight.

The path forward for emerging markets hinges on several variables:

While the potential for contagion remains real, a strategic mix of domestic reforms, international cooperation, and innovative financing could chart a more stable course for emerging market economies.

By navigating these complex trade-offs with targeted policy action and global solidarity, EMEs can address immediate debt pressures and lay the groundwork for sustainable, inclusive growth in the years ahead.

References